Briefing: startup deals in May 2017

Category: Uncategorized

Each month, Beauhurst issues a briefing on the most interesting UK startup deals from the previous month; in this case, May 2017. It is covered by various news publications and subsequently published here.

If you’d like to join the distribution list or write about the data, do get in touch at marketing@beauhurst.com: we’re happy to take specific requests, and always open to new partnerships. We just ask for a credit and link back to about.beauhurst.com.

Overview

Number of deals: 202

Total raised: £941m

Average deal size: £4.95m

Average pre-money valuation: £8.25m

Commentary

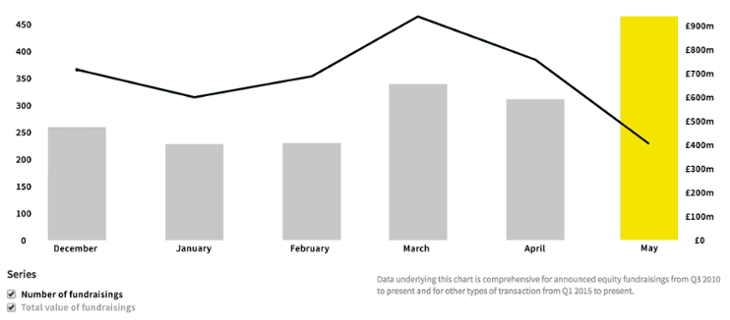

May saw an unusually high amount invested (up £351m from April’s £590m) in high-growth companies. This was due almost exclusively to Improbable’s huge raise – the largest amount raised by a UK company since Beauhurst’s records began, seven years ago.

Deal numbers, however, continued their steep decline from April, plummeting to 202 from 379 in April and 470 in March. Slightly lower numbers than the previous month are always to be expected, given that companies which closed rounds at the end of May still have a week in which to file the deal, but the scale of this drop and its continuation from April suggests other factors at issue; uncertainty surrounding the General Election might play a role.

There were 322 deals this time last year, and it is unlikely that we will see the shortfall made up in the coming two weeks. That said, every May since 2010 has seen a deal dropoff (frequently large) from the preceding April – possibly related to the financial year’s end.

Crowdcube participated in the most fundraisings (4) this May of any funder, followed jointly by Accelerated Digital Ventures, Mercia Fund Management, Seedrs, and Woodford Investment Management.

Biggest deals

1. Improbable

Improbable is developing technology that facilitates the creation of simulated worlds – software that simulates the behaviours of a large number of entities within a given environment. This has applications for gaming, defence, energy, transportation, health and finance.

Deal date: 11th May 2017

Deal amount: $502 (£389)

Investors: SoftBank Capital

2. Gigaclear

Gigaclear provides ultrafast broadband internet access using fibre-optic service to homes and businesses in rural communities.

This was follow-on capital from Infracapital and Woodford. Gigaclear’s pre-money valuation was £136m.

3. Claranet

Claranet provides managed IT services, including hosting, networks and communications support.

Two weeks after this deal (Claranet’s first), the company made three acquisitions: Sec-1, ITEN Solutions, and Oxalide.

4. MiNA Therapeutics

MiNA Therapeutics develops medical treatments by returning normal function to patients’ cells using small activating RNA to target and activate genes. The company focuses on liver diseases.

5. StarLeaf

StarLeaf operates a global video communications network and develops video conference calling technology.