5 signs of startup potential that investors shouldn’t ignore

Category: Uncategorized

Many venture capital firms pride themselves on a strong stream of inbound interest from founders, and only invest in companies with a mutual connection and warm introductions. But it’s very difficult to curate a diverse portfolio of startup companies if you’re just relying on inbound deal flow. You’ll automatically blind yourself to thousands of other viable opportunities, especially in areas of high innovation where you don’t have an inside contact.

In order to get a true understanding of the investment opportunities that are out there, and sufficient information to inform a sound investment decision, you’ll need access to a structured and accurate dataset.

The Beauhurst platform provides just this, with curated profiles on 32k companies, all of which have hit one of our eight ‘tracking triggers’, indicating that they are ambitious or high-growth.

Whether you work at an early stage venture capital firm, carry out business development for an equity crowdfunding platform, or run a later stage fund, this dataset of high potential companies is a great place to source new deals from.

In this post, we’ll show you five ways to narrow down these companies to find the most relevant opportunities for your fund, and identify the best startups to put your money behind.

1. Recently raised a small friends, family and angel round

Raising finance from friends and family is usually the first step in a company’s funding journey. An injection of around £50k can often help get a small business off the ground, and fund the early stages of validation plus development and deployment of an MVP (depending on how capital-intensive the venture is, of course).

At this stage, the venture is still very high-risk, but as it grows and develops a market-ready offering, it will likely look to venture capitalists and other types of startup investors that can offer larger cheque sizes, expertise and access to business networks.

In the past year alone, 305 companies have raised a first time funding round of less than £50k, most likely drawing on their personal connections to fund the project.

For example, Bronze is a young startup that develops music composition software, allowing musicians to utilise AI and machine learning as creative tools. The company completed its first fundraising, worth precisely £50k, in April 2020. The round saw 15 individuals added to the ownership filing, 11 of which were completely new to startup investing, suggesting they probably had a personal connection to the founding team. The remaining four had shareholdings in other companies, and are perhaps fledgling angels. We anticipate that this capital will help to commercialise Bronze’s technology.

Of the 540 companies that raised a first time funding of £50k or less during 2015, 295 (55%) have gone on to raise more funding, showing that having raised a friends and family round is a good indicator that a startup will need more capital down the line. This cohort includes payment processor Curve and orbital launch company Orbex.

You can find out about recent fundraisings from news outlets and company websites, but with this strategy you’d miss out on the 75% of early stage funding rounds that aren’t publicly announced. And that’s not to mention that it would be near impossible to keep an eye on the 25% that are visible. The only way to make sure you have complete oversight of all the fundraisings in the UK, including those that go unannounced, is with the Beauhurst platform. We have all the data you need, and provide the tools to easily search across it.

2. Recently raised money from notable angel investors

A similar indicator to above, but with a slightly different approach, tracking the activity of notable angel investors (or lower profile angels who you personally trust) can be a quick and effective way to source new deals. This means piggy-backing off the due diligence carried by top angels to find exciting companies that will soon be in need of larger sums of money.

Top angels are accredited investors, who are less likely to be biased towards a founding team than their friends and family. They’ll require certain criteria to be hit before investing in a startup, and will pay more attention to the financial health of a company, as well as the competence and potential of its founders.

It’s easy to identify angel investors with a good track record using Beauhurst— just search for people who have shareholdings in multiple exited businesses, or who have a number of active shareholdings at private companies and a significant estimated paper wealth.

Then, add the resulting list to a Collection in order to track their activity. We’ll send you a notification when we learn of any new shareholdings for these individuals, indicating that they’ve added a new startup to their investment portfolio.

3. Has attended an accelerator programme

These programmes do what they say on the tin, helping companies to accelerate their growth with access to office space, business support and mentoring (amongst other possible perks). At the end of the programme, there will usually be a demo day where founders can meet and pitch to potential investors.

Our research has shown that, on average, companies that attend accelerators raise 44% more money than those that don’t, and are also 75% more valuable. Clearly, the pool of companies that are currently attending or have recently graduated from an accelerator programme is a good place to look for new investment opportunities.

But you need to be picky about which accelerators you trust, as they don’t all have the same acceptance criteria or success rates. At Beauhurst, we track the most interesting accelerator programmes in the country and all of the attending companies — that’s any programme that validates the ambition and growth prospects of participating companies. All of them will have a start and finish date, structure, competitive application process and no (or low) attendance fees.

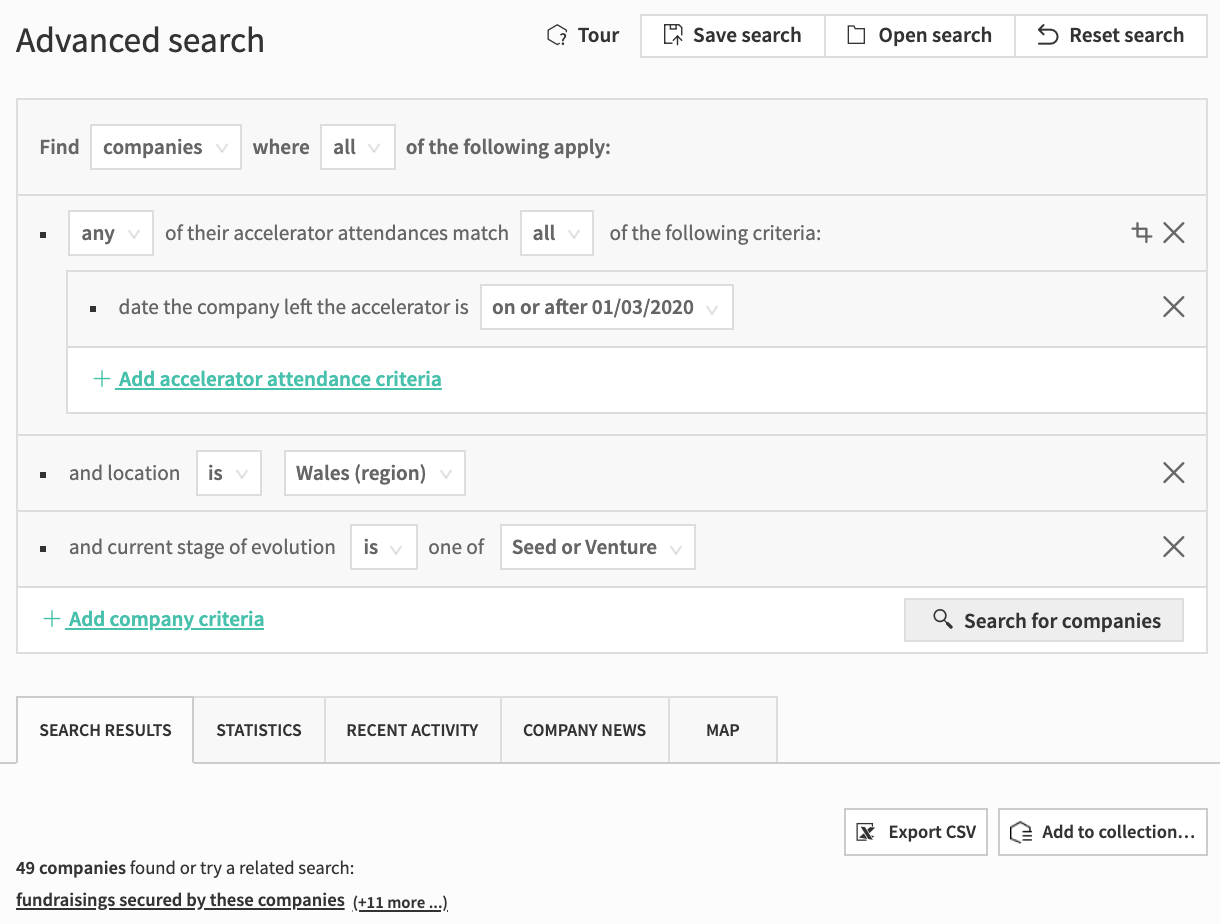

We believe that any company that attends one of these programmes is on a promising growth trajectory. We also make it easy to search over all the companies that have recently graduated from an accelerator, so you can browse through all of them.

4. The startup is run by serial entrepreneur, who has already led a company to exit

It’s fairly safe to assume that serial entrepreneurs who have previously led a company to an IPO or an acquisition are good founders to invest in. They have great experience to draw upon, which will help steer them in the right direction in future ventures. Successful serial entrepreneurs are often also angel investors themselves, so know expectations of returns on investment from both sides of the table.

Take, for example, Alex Chesterman. Alex founded property website Zoopla back in 2007, and led the company to a £1b IPO on the London Stock Exchange in 2014. He also founded ScreenSelect, which later became LoveFilm, and is one of the most active angel investors in the UK tech scene. In September 2018 he stepped down as CEO of Zoopla and founded used car marketplace, Cazoo. Within two years of operating, Cazoo has secured £205m of equity finance over five funding rounds, with participation from Eight Roads Ventures, Octopus Ventures and Stride.VC. Alex’s reputation and previous successes no doubt played a large role in the investment decision.

We currently track 217 companies which are founded by an entrepreneur who has previously led a company to an exit. Our Networks feature makes it possible to search across these people, and see all the UK startups they’re involved in. You can also see their contact details, links to social media, and a visualisation of their networks — perhaps you already have a mutual connection, and can ask for a warm introduction.

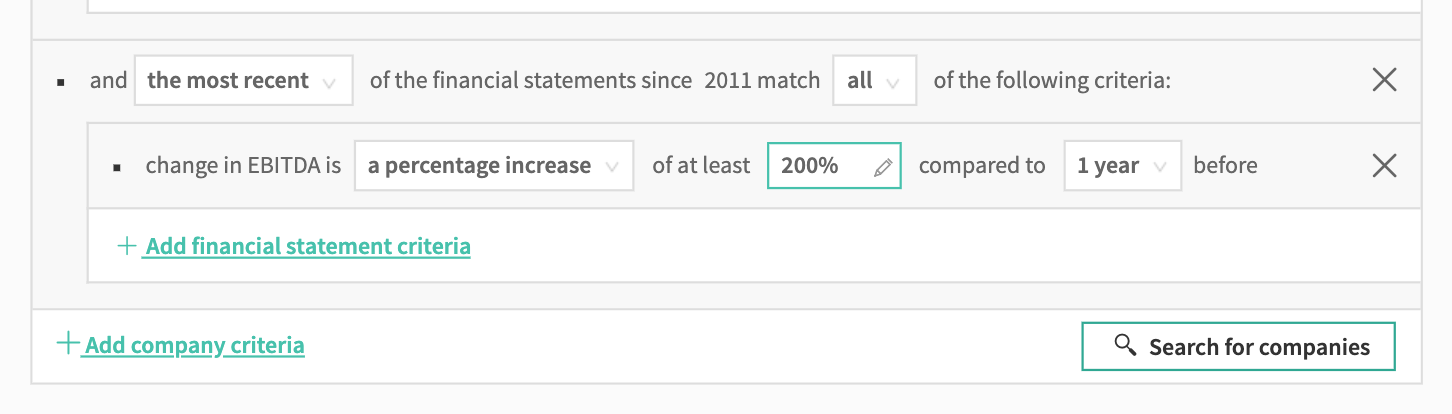

5. A fast-growing turnover or EBITDA

Company financials always play a key part in any investment decision. Turnover and EBITDA (earnings before interest, taxes, depreciation, and amortization) are commonly used as indicators of a company’s potential. Even if a business is operating at a significant loss, a fast growing turnover or EBITDA shows that their product or service has traction, market fit and a strong customer base. The idea behind this is that generating income is harder to do than reducing costs, which can be done with the help of investors and consultants later down the line.

Not all companies will disclose their turnover or EBITDA (private businesses with a turnover of less than £10.2m are not legally required to file full accounts), but if they do, then you can find all the details on Companies House, but this has a very basic search function — you’d have to know which company you want to search for, as there is no way to search for businesses by their filings.

The Beauhurst platform makes it much easier to do this. We curate all the financial data from Companies House into a structured and searchable format. Just specify which metric and rate of change you’re interested in.

Concerned about how these figures will have been affected during the pandemic? Our COVID-19 impact data will provide a good indication of the extent to which a company has been hit. This data informs you whether the company is experiencing a negative, low, or potentially positive impact, before you make contact with them.

How can I streamline the search process?

The most powerful way of finding investment opportunities is by combining these criteria into one search query. Beauhurst’s Advanced Search allows you to combine as many criteria as you like, whether they’re from the list above or more general parameters such as company location and sectors of operation.

Once you have a refined list of companies, you can reach out to see if they’re looking for new investment, or export all their data into a spreadsheet to work on more complex calculations.

Want to see how Beauhurst can help you carry out the next stage of the process? We’ve outlined how the platform allows you to perform more effective due diligence.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.