Accelerating the UK

Effective accelerator programmes have become one of the most important ways to nurture young companies from startup to scaleup and beyond. Since their inception in Silicon Valley with Y Combinator in 2005, these programmes have helped entrepreneurs grow their ideas from just that: ideas, into successful, fast-growing businesses.

In the UK, the accelerator scene is thriving. Our data shows that more companies than ever are turning to such programmes to help them grow. We have also found that accelerators have a clear positive impact on company growth, investment and valuation.

However, we of course know that not every company is right for an accelerator programme, and indeed, not every accelerator can help companies grow. Our findings echo this. Some accelerators are more effective than others and some types of companies, sectors and stages are more receptive to the support they offer.

This report is not intended as advice to entrepreneurs – to immediately seek out their nearest accelerator (or not!) – but instead is an attempt to help those who work at, and with, high-growth companies to better understand what accelerators do and how they affect the wider high-growth ecosystem.

We hope you enjoy reading this as much as the team did putting this research together, and we genuinely hope you find it useful. As with all our reports, this has been created using Beauhurst data, which lives in our market-leading platform. Find out more about it here.

henry whorwood

Henry leads Beauhurst’s Research & Consultancy team, and is an expert on equity finance and high-growth business. He has worked on briefs for clients including Barclays, Syndicate Room, Innovate UK, Smith & Williamson and the British Business Bank. Henry regularly gives presentations on finance and market trends at events around the country. Henry studied Classics at the University of Oxford.

Key findings

Contents

What is an accelerator?

Simply put, an accelerator offers programmes to help startups grow. The number of these programmes has grown dramatically in the last few years, with accelerators specialising in everything from niche verticals to a specific stage of company growth. We believe (and indeed our data shows) that attending an accelerator is a good indicator of a company’s potential to grow big and fast. But with such a wide variety of accelerators and related programmes like incubators, startup studios and co-working spaces, it can be difficult to tell which of these programmes are true indicators of future success. In order to validate the ambition and growth prospects of their participants, we believe an accelerator programme must meet the following criteria:- The duration is a set period of time

- Over this period, the programme should have a clear structure

(a syllabus, milestones, and/or events with required attendance) - The application process is competitive

- No or minimal joining fees

It is no surprise that an area priding itself on disrupting industries would experience disruption of its own. Nimble accelerators should continuously evolve to stay relevant — from specialising in a particular stage of growth of the startup process to entering emerging markets, and focusing on partnerships with corporations.

Startupbootcamp Tweet

number of accelerators

number of accelerator managers

number of recorded attendances

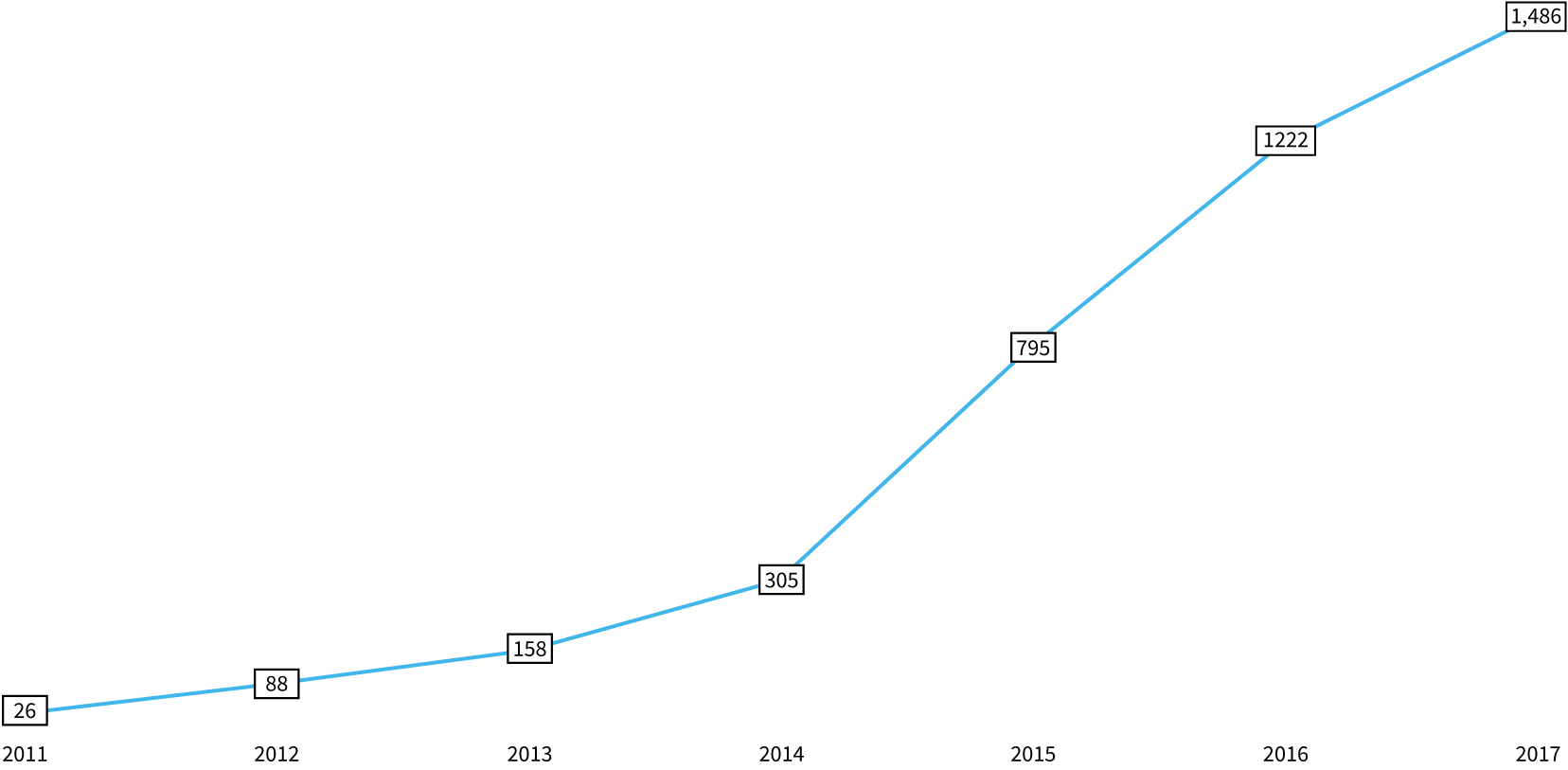

The number of accelerator attendances has increased significantly year-on-year since our records began in 2011, growing to a record 1,486 in 2017. With accelerators now such a popular option for young companies, awareness of accelerators among entrepreneurs has increased significantly. There is also a wide range of programmes available, with companies now able to be far more selective about the programmes they choose to join.

We’ll soon reach a point in the market where there’s not only a lot of choice but also a lot of diversity among accelerators, in terms of both specialism and stage of growth of the companies taking part.

L Marks Tweet

number of accelerator attendances with a known date by year

There was a big boom in programmes and people got a little over excited, but we think entrepreneurs are much better at judging accelerators now. Companies are doing their due diligence and being savvy about the real benefits they can get from one programme over another.

CyLon Tweet

Which areas have the most accelerators?

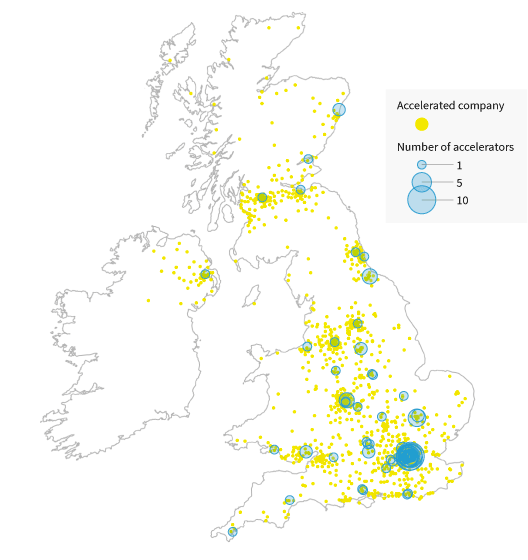

Accelerator programmes can be found in all the UK’s major cities, with attending companies clustered around them. The greatest density of programmes is in London, which has 117. Within London, the postcode with the most accelerators is EC2A — a part of Shoreditch near the Silicon Roundabout. Looking outside of the capital, the top prize goes to CB2 in Cambridge, which has 4 accelerator programmes.Location of accelerated companies and accelerators by postcode

Accelerated companies are more distributed than the accelerators they graduated from. Clearly businesses are happy to travel to gain the services provided by the right accelerator.

Henry Whorwood Beauhurst Tweet

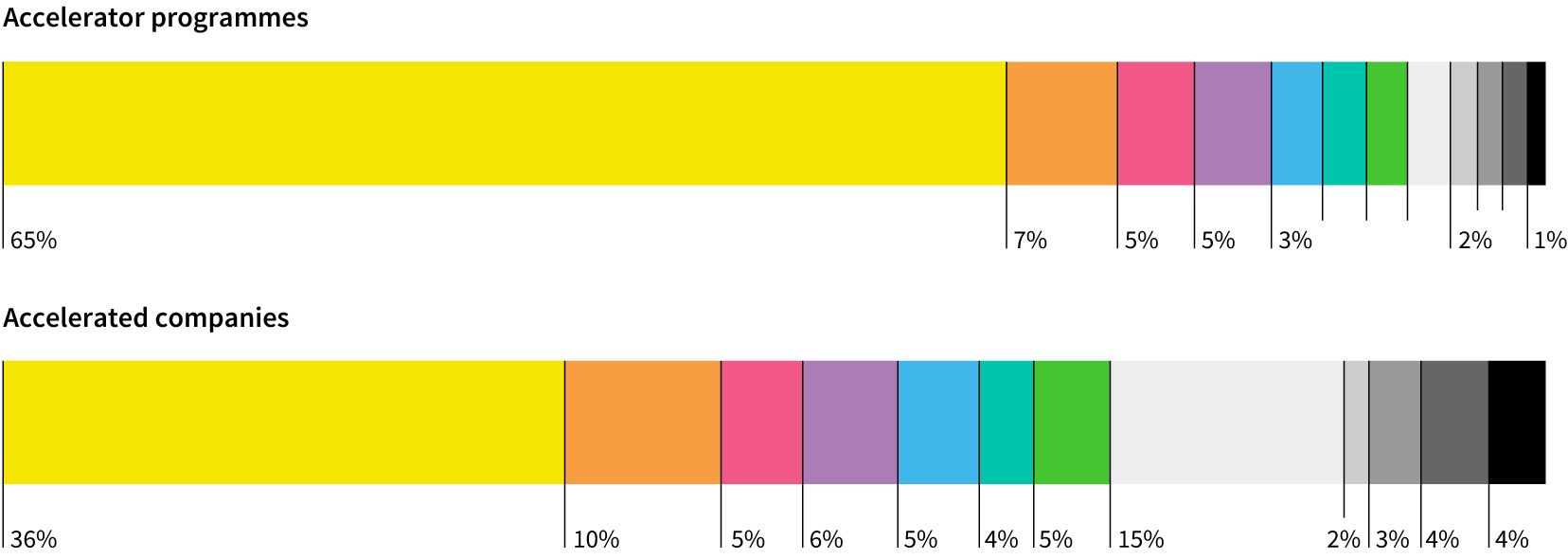

While 65% of the UK’s accelerators can be found in London, accelerated companies are more distributed than the accelerators they graduated from. Businesses will travel to gain the services provided by the right accelerator.

15% of accelerated companies are registered in Scotland, which is mostly due to the Royal Bank of Scotland’s Entrepreneur Accelerator network. This ran for three years in partnership with Entrepreneurial Spark. At the beginning of 2018, the bank brought the fully funded programme in-house. It currently runs 12 Entrepreneur Accelerator hubs in key cities across the UK, making up the UK’s largest free business accelerator network and is capable of supporting up to 1,000 scale-up entrepreneurs simultaneously.

By bringing the Entrepreneur Accelerator network in-house we’ve been able to develop our fully-funded programme around the needs of entrepreneurs who want to grow and scale their business.

Gordon Merrylees NatWest / RBS Tweet

regional percent share of scaleups and percent share of accelerators

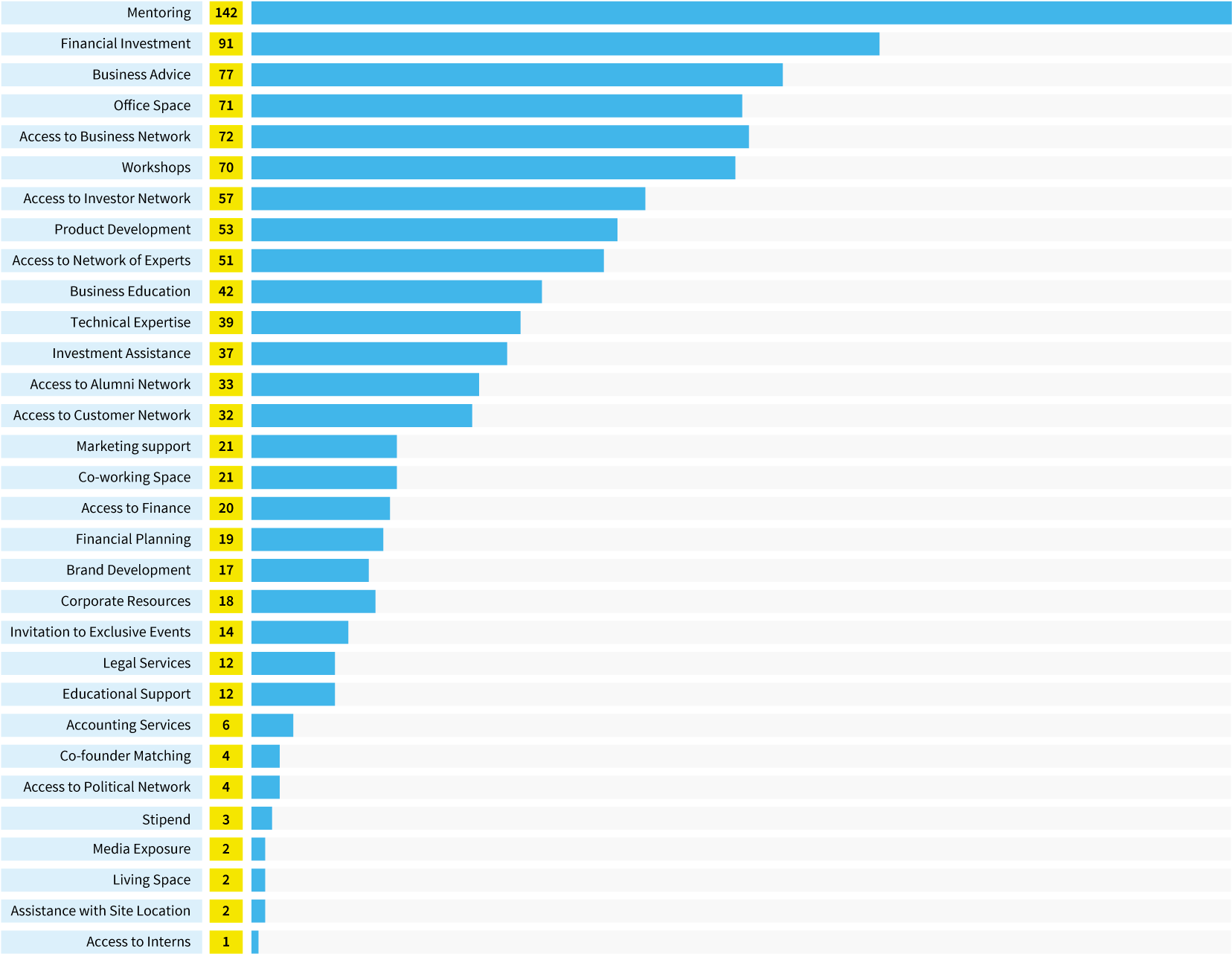

By far the most frequent listed benefit offered by accelerator programmes is mentoring, which 76% of accelerators present as a benefit. This is followed by financial investment, which is offered by 49% of programmes.

listed benefits offered by accelerators

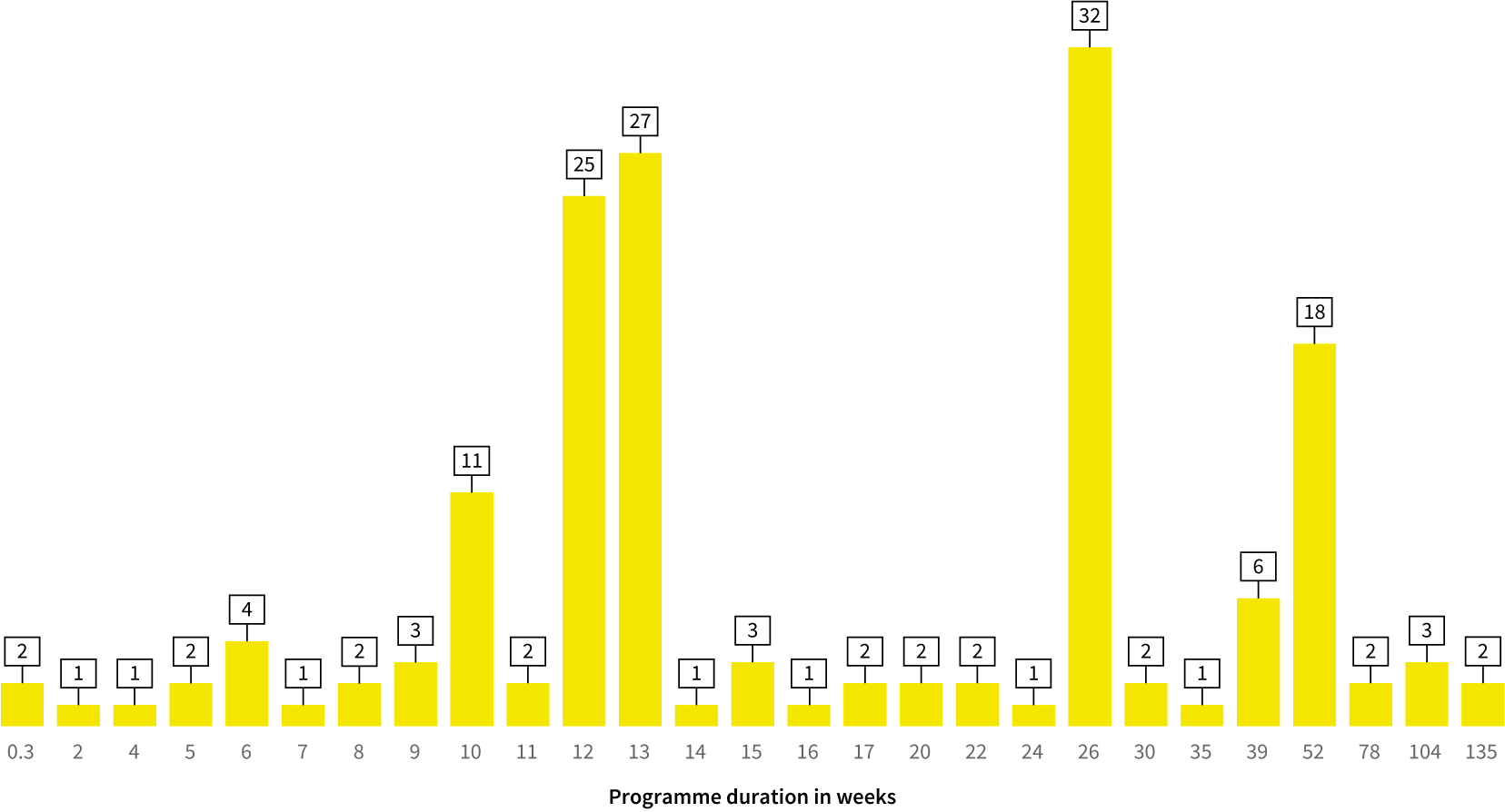

33% of accelerator programmes with a known duration are 12 or 13 weeks long — the conventional three month length of programmes such as Y-Combinator and Techstars. Other peaks are seen around the six month and one year mark.

accelerator programme duration

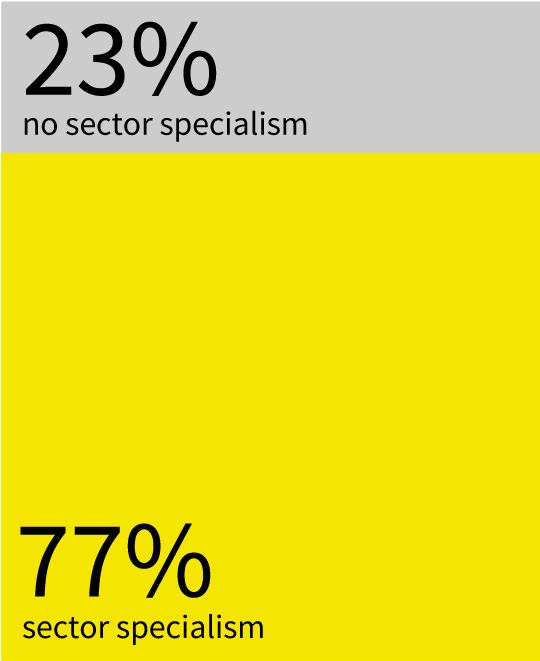

sector specialism?

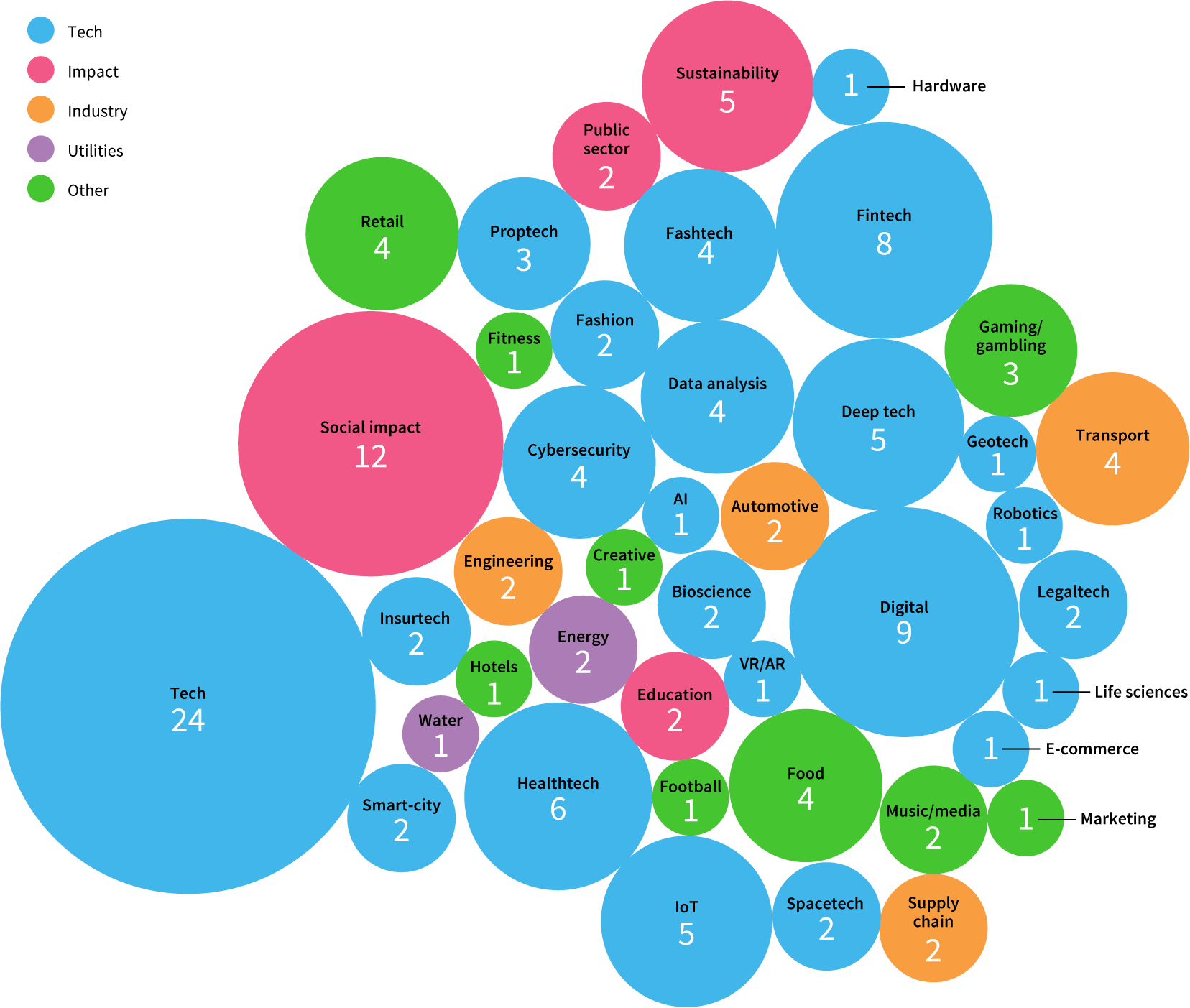

77% of accelerators have a declared sector specialism. When broadly grouped into categories, the majority of these are focused on tech, with 48% defining themselves as tech accelerators. This comes as no surprise, since by definition most accelerators are for technology businesses. Perhaps more interestingly a significant portion (10%) of accelerator programmes are “impact” focused, looking to encourage innovative businesses who will benefit society.

self-declared accelerator sector specialisms

Our founders saw a huge gap in early-stage cyber. The UK is good, but we need to do more to stay up there with Israel and the US. The sector is a very difficult one to prove a concept in as a startup, as you can't just fail and try again.

CyLon Tweet

the company

Founded by CEO James Hadley, Immersive Labs is a gamified online learning platform for cyber skills, allowing organisations to upskill their workforces and attract new talent.

Their story

In 2017 Immersive Labs was just two people and had been turned down by another accelerator. James was struggling to work out what to do next and was ready to give up. Within two years of completing CyLon, Immersive Labs had a major contract with BAE Systems, investment from Goldman Sachs, and a team of over 50 people.

As entrepreneurs ourselves, we know first hand how important a network of mentors, partners, corporate clients, and investors is when your company is scaling-up. We thrive to enable long-lasting, industry-specific relationships that lay the groundwork for building world-class ventures.

Startupbootcamp

Entrepreneurs in our Labs develop unparalleled relationships with business leaders in their target market. They are uniquely placed to develop business propositions which will not only benefit the market but strengthen and shape it. The entrepreneurs are then well-placed to secure partnerships with the corporates, which in turn generate crucial revenue for their growing businesses. The biggest benefit of our Innovation Labs has to be the way they create real growth for young companies.

L Marks

We define success for our companies as scale-up success and industry transformation. Going through one of our accelerators lets startups work on actual, validated problems, and have access to corporate assets such as data, talent and mentors.

The Bakery

We consider introductions to potential customers the most important thing. Getting that traction is critical to so many companies' future success.

CyLon

number of companies analysed

What stage of evolution are they at?

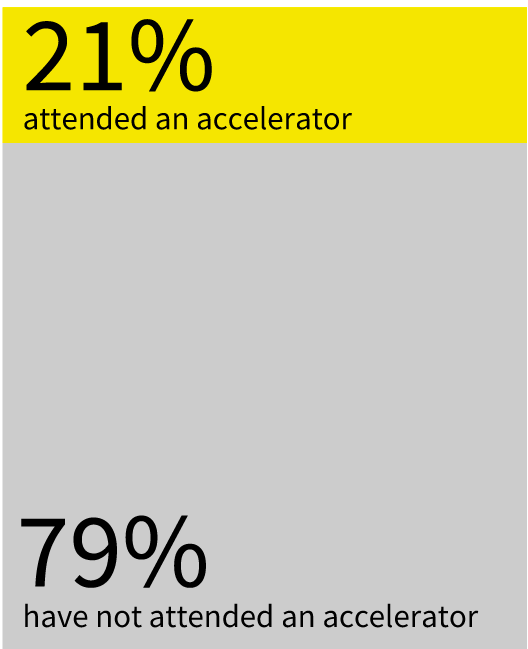

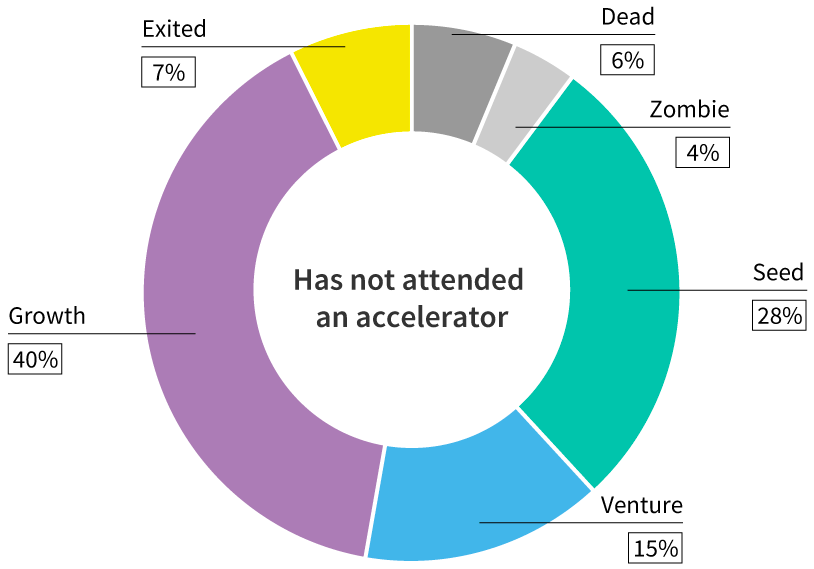

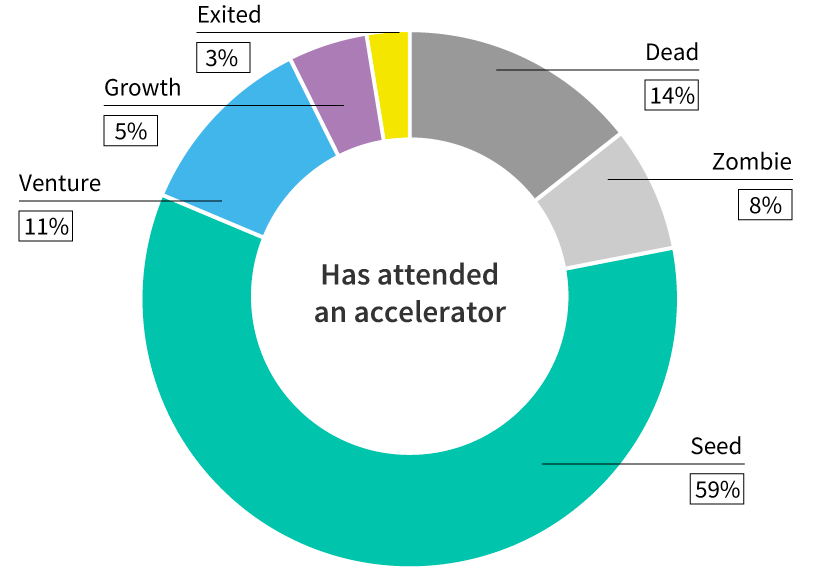

Compared with companies that haven’t attended an accelerator, accelerated companies are far more likely to be at the seed stage. This makes sense given that the popularity of accelerators is a fairly recent phenomenon in the UK and their traditional focus on early-stage startups. It is also important to note that the set of non-accelerated companies includes a large number of established scaleups.

At 14%, the proportion of dead companies is also much higher for accelerated companies, highlighting the riskier, earlier-stage nature of most accelerated businesses.

current stage of evolution of high-growth companies

Where are these companies?

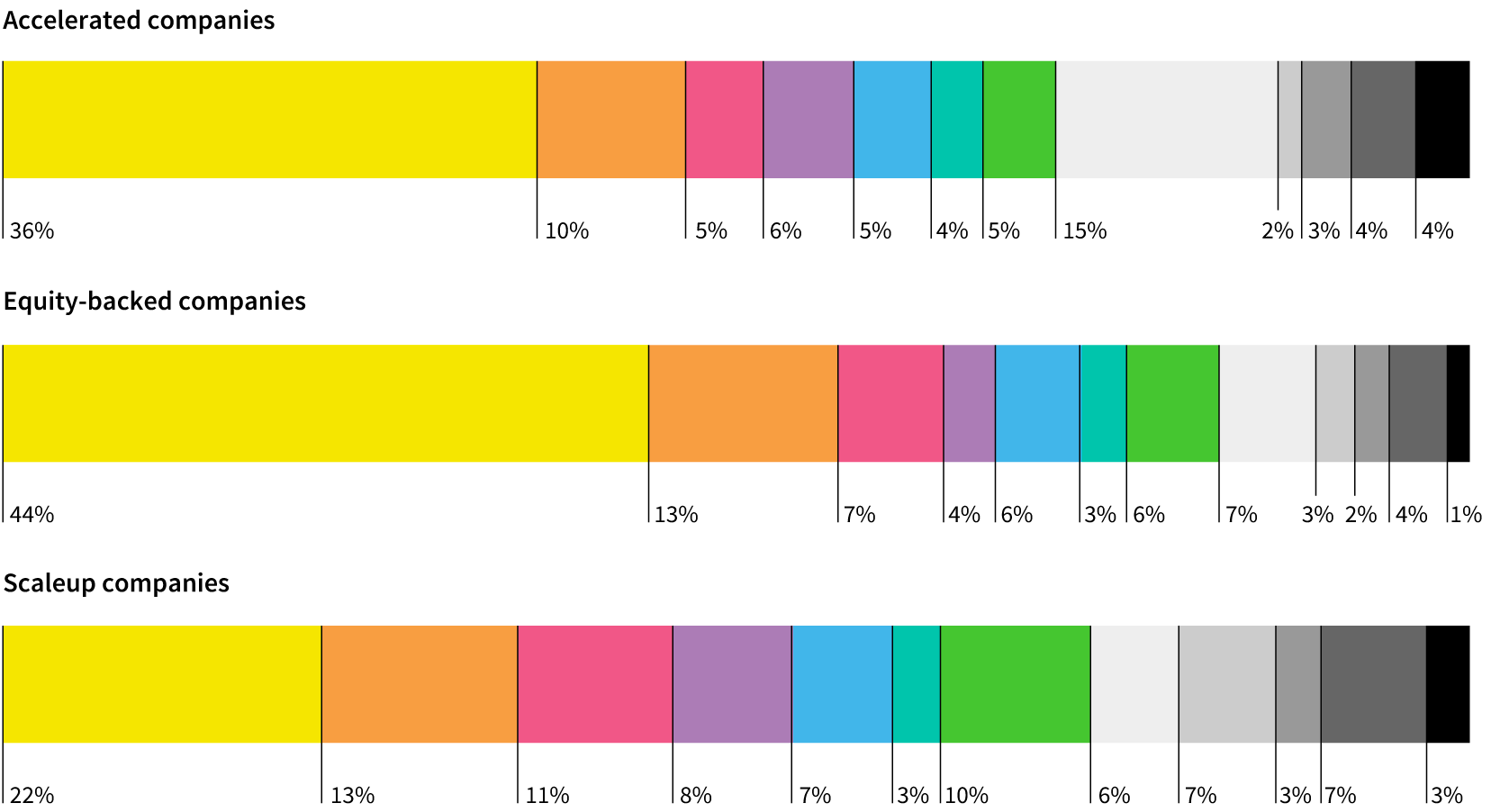

Despite the fact that the majority of accelerators are based in London, their attendees come from across the UK, with only 36% of accelerated companies based in the capital. Although still the most popular location by far, this is a more balanced picture than equity backed companies, where 44% are based in London. Companies are often likely to re-locate to London when they’re ready to raise equity finance, given the easier access to investors and networking.regional distribution of companies

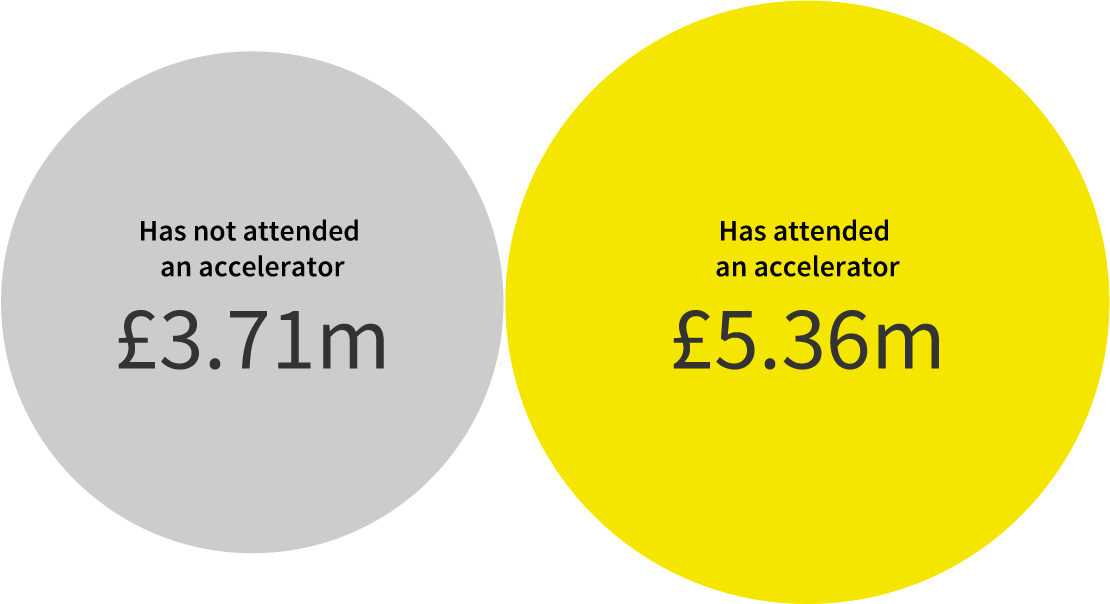

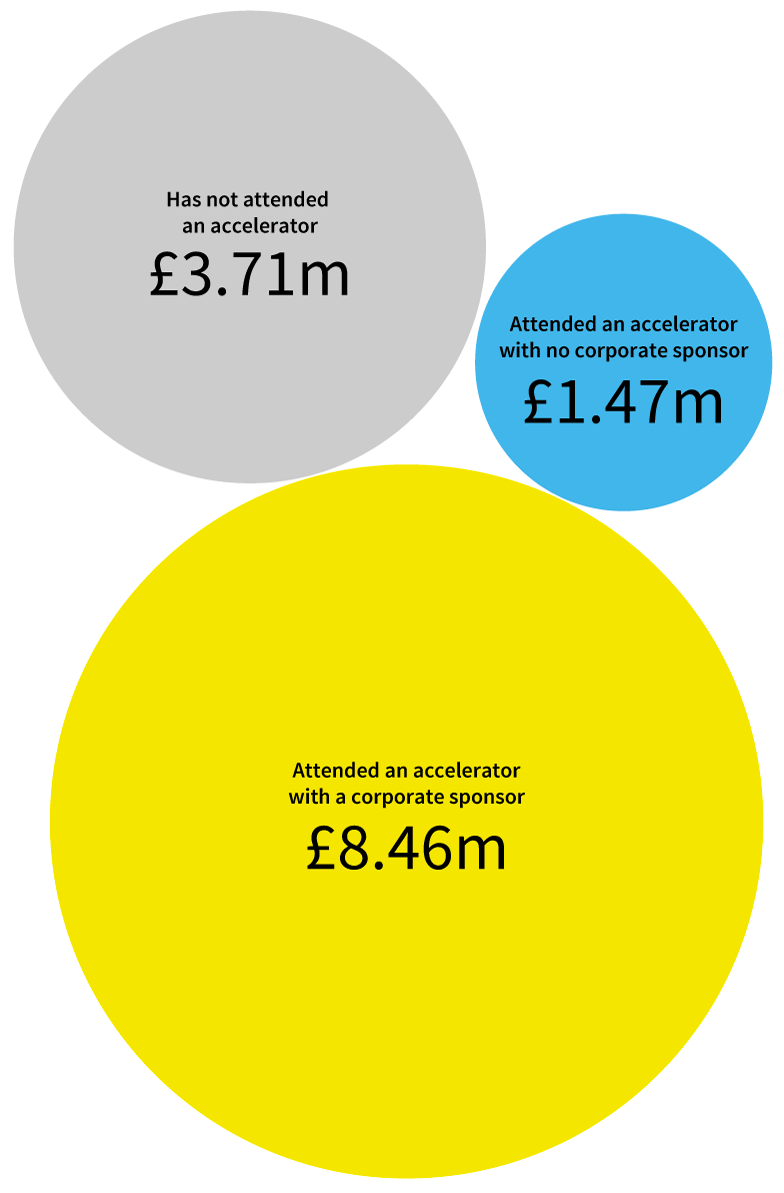

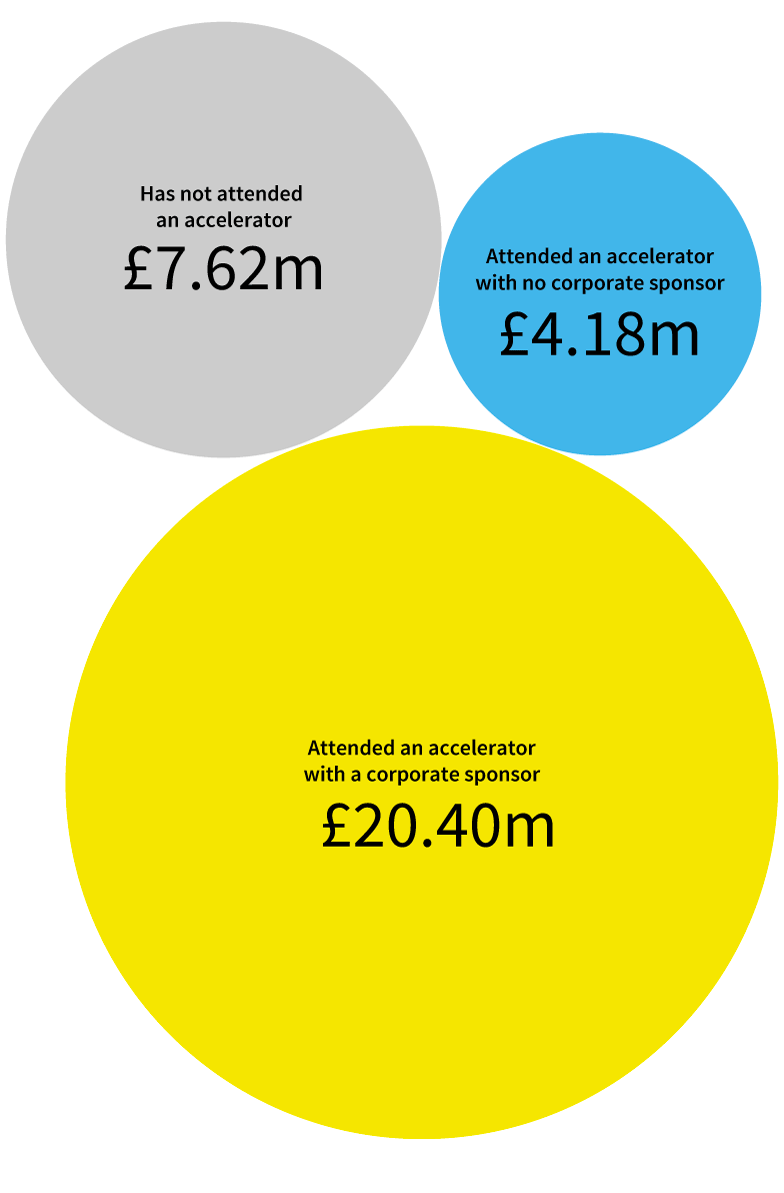

How much funding do accelerated companies receive?

At Beauhurst we view raising finance as a key indicator of a startup’s growth potential. Is it a useful metric for measuring the success of accelerated companies? Yes, according to Startupbootcamp. While they define success for their companies as partnering with a corporate, or finding clients, the amount raised is also an important indicator. Investors in the current climate are looking for safer bets, and want to see traction and revenue before putting money down. Attending an accelerator programme can help companies achieve just that. Both CyLon and L Marks echoed these thoughts, noting that their programmes can provide validation (corporate or otherwise), and introductions to investors. So how do companies that have both raised equity and attended an accelerator compare to those that have only raised equity? Companies that have done both make up 14% of equity-backed businesses — that’s 1941 companies across the UK. At first glance, both the average amount raised and average pre-money valuation are improved significantly by attending an accelerator.Among the many benefits of our programmes is the corporate validation that they can provide for young companies developing new and innovative technologies. Validation from an industry leader can make all the difference when it comes to winning future investment.

L Marks Tweet

equity backed companies

average amount raised

Accelerated companies raise 44% more and at a 75% higher valuation – a great validation of the benefits delivered by accelerators!

Henry Whorwood Beauhurst Tweet

average pre-money valuation

However, the figures are influenced enormously by the companies at the growth-stage. This is likely due to the self-selecting element of later-stage accelerators — their cohorts are made up of companies who have already proved themselves successful at the earlier stages of evolution.

At the seed and venture stages companies that have not been through accelerators rank higher in both average amount raised and average valuation. Why might this be? We suspect companies who have not been through accelerators need more funding to achieve the same level of growth, while accelerator attendees are given a head start with a lower initial level of funding required.

Average amount raised

average valuation

Who runs the most programmes?

The majority of managers only run one accelerator programme, with only 15% offering two or more.Of these managers, L Marks offers the most programmes, with 20 tracked by Beauhurst. However, many accelerators also offer other types of programmes which won’t be considered in the data set used for this report, such as shorter, less formal pre-accelerators or incubator type services.

most prolific accelerator managers

We ran our first programme, JLAB, with John Lewis in 2014. A few corporates sponsored accelerators at that time, but none truly collaborated with startups. We saw a gap in the market for programmes where startups can work closely with corporates to develop and trial products. The corporate is fully engaged and experiences technologies which have the potential to transform their business. We pave the way for long-term commercial partnerships between corporates and startups.

L Marks Tweet

The accelerator

Through the BMW Innovation Lab, BMW was looking to use fintech to digitise the customer experience, make the most of data, and maximise the use of the vehicle fleet.

startup profile

Wrisk entered the BMW Innovation Lab as a wildcard candidate, with only a prototype, and ended it with a commercial agreement to be the sole insurance provider for BMW’s UK financial services arm. Their app-based platform prioritises simplicity, transparency and flexibility, making it fast and easy to manage home, motor and travel insurance in one place.

Which accelerators do companies go on to raise the most money from?

Looking at the average amount raised by companies from each accelerator programme is an interesting metric. If the aim is to prepare companies to move faster towards their next stage of growth, then a larger average amount raised could indicate more success in doing so. However, the amounts are as much an indication of the stage of growth the accelerator is targeted at as their success, and the age of the programme. As such, late-stage accelerators such as Future Fifty, Upscale and ELITE top the list.rank by total average amount raised

Who sponsors accelerators?

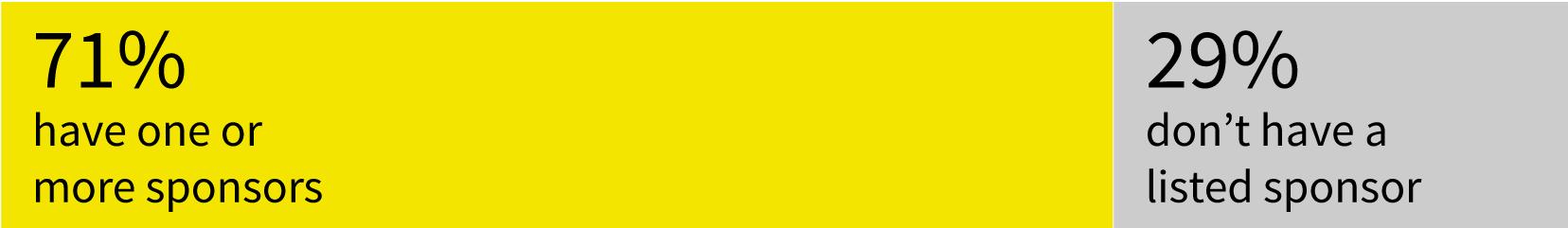

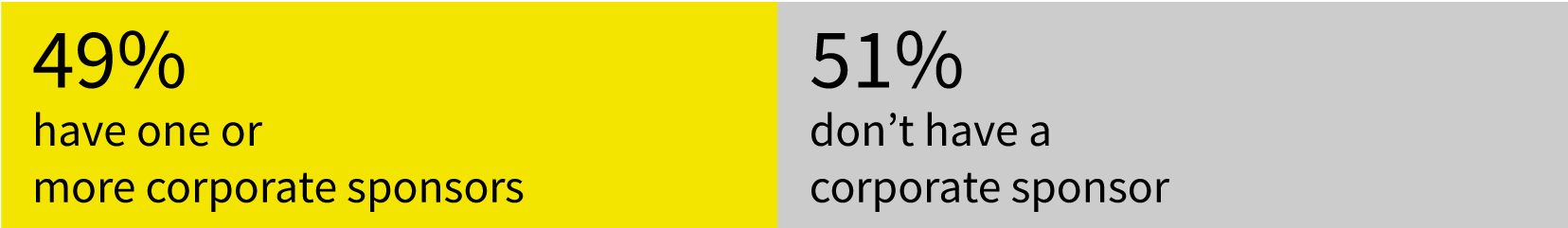

The majority of accelerators are supported by other organisations. The nature of these relationships can vary greatly from accelerator to accelerator and sponsor to sponsor, encompassing anything from free event space to full financial backing. The majority of sponsors are corporates, accounting for 56%. The second most common sponsor type is not-for-profit organisations, accounting for 9%. The most frequent sponsor of accelerator programmes is the European Regional Development Fund. It will be interesting to see how this picture changes post-Brexit.percent of accelerators that have at least one listed sponsor

most frequent sponsor

Accelerators are vital to helping early-stage businesses develop the knowledge and drive to build a scalable business. Perhaps even more important, start-ups and scale-ups get the chance to plug in to an incubator network and connect to corporates that can help providing advice, funding, future business and more. When designing our Barclays Eagle Lab network and accelerator, Eagle Lab Flight, we bring all this together so participants gain lasting value from the programme.

Barclays Eagle Lab Tweet

percent of accelerators that have at least one corporate sponsor

For corporate accelerators, the key objective is often to source innovation through startups and position the accelerator as a strategic industry fit to the organization broader goals. While they can be well funded, they struggle to attract the best operators condensing the time and effort, and often lack exposure to the full ecosystem to support their startups. Processes such as scouting, qualifying and strategically aligning startups to their core objectives could take months to get through whereas we’ve condensed it into an intense two-three week process.

Startupbootcamp

For an accelerator to prove productive, a corporate must be completely invested in it. On that basis, we are in favour of corporates running innovation programmes. That said, it takes a lot more than providing capital and freeing up office space. Accelerators should cultivate symbiotic relationships between corporates and startups – relationships which can only develop when open innovation is embraced and all parties recognise that no one has a monopoly over the right ideas. It’s for that reason that we find that accelerators which champion collaboration generate the most successful programmes. It’s about focusing on how each side can benefit the other and supporting each other through challenges. When startups and corporates collaborate in this way, both parties will experience benefits which lead to genuine change, both financial and cultural.

L Marks

Corporates have a tendency to isolate innovation programmes outside of the core business, when in actuality, they should be immersing themselves in the company entirely. For a corporate accelerator to be successful, they must:

Find the open people in the organisation. Those with a budget, a problem to solve and who really care about transformation.

Start with the challenge not the start up

Search for the best startups against the problem – not just ‘the most available’ in a cohort of 12.

Start small. The quicker the trial the greater the chance for success.

Get an internal unblocker. Their sole task is to get corporate machinery working for — not against – entrepreneurs. This happens through unlocking the assets (data, talent, distribution) but also finance, legal, risk, procurement etc.

The Bakery

Accelerators with a corporate sponsor are more likely to have a sector specialism, which makes sense as corporates will partner with accelerators in their own sector so they can find companies that are strategically useful to them.

corporate sector specialism?

Our programmes have helped 220 scale-ups, all of which want access to new customers and many of which want to raise capital. The differentiator is the global corporate network we can connect into the programme, combined with the industry insights and corporate challenges we share as an advisory firm. Scale-ups get increased engagement, collaboration and commercial opportunities for the benefit of both sides.

PwC Tweet

a corporate partnership

Lloyds Banking Group became the partner to Startupbootcamp’s FinTech programme in 2014. While undertaking a digital transformation programme, they wanted to scan the market for innovation and find opportunities to provide better service to customers.

the result

Along with participating in events and the SBC Colab programme, Lloyds has partnered with alumni WoraPay, testing their mobile payment technology in Lloyds office cafes. The collaboration has all but eliminated queuing and saved thousands of hours of employee time.

Number of companies

Our programmes bring together corporates and startups as equal partners with the potential to not only learn from one another but propel one another. While startups are of course focused on winning a big corporate client, they are not simply competing for a contract, as is perhaps the case on an accelerator with a corporate sponsor rather than a corporate partner.

L Marks Tweet

average amount raised

average pre-money valuation

The Bakery run “challenge-led” acceleration programmes where startups solve validated corporate challenges.

The challenge

A retail bank wanted to improve their end-to-end talent management process.

The solution

A series of diverse companies explored everything from blockchain applicant vetting to neuroscience-based assessment games. The client decided to focus on screening candidates more efficiently, and following trials, MeVitae is now working with the client to shortlist CVs using AI.

Our data clearly shows that accelerators have become a popular option for young companies looking to grow. With such popularity, and such a wide variety of programmes available, what’s next for the accelerator ecosystem?

CyLon think it’s inevitable that some accelerators will become funds, and we agree. There’s a gap in the market between accelerators and VCs, usually filled by angels, where accelerator-managed micro funds could invest in companies they’ve done extended due diligence on. Perhaps we might even see more partnerships between funds and accelerators.

The days of the generalised programme, ending in a demo day and rolodex of contacts, might well be over. We suspect the current trend for more specialised accelerator programmes will continue. L Marks suggest programmes will be built around more specific opportunities and nurturing more meaningful relationships, while Startupbootcamp think we’ll see new types of programmes, perhaps with less time commitment.

Here at Beauhurst we’ll continue to track the companies graduating from accelerators. We’ll also continue to analyse this data to better understand the benefit accelerators bring to their companies. To this end we’re working with Nesta, the London School of Economics and the Open University on a project for the Department for Business, Energy and Industrial Strategy to understand how much accelerators help businesses grow and which services are most effective at delivering this growth.

Like startups themselves, accelerators are exploring new business models and ways of differentiating themselves from others. Combined with the entrance of new sponsors with different missions, this means that the space continues to evolve rapidly.

Christopher Haley

Nesta Tweet